The Role of Energy in Economic Growth

Posted by nate hagens on October 19, 2011 - 10:58am

Ecological economist David Stern recently wrote a paper on the importance of energy for economic growth aptly titled 'The Role of Energy in Economic Growth'. His overview paper follows a long chain of biophysical research on this topic from Schumpeter in the 50s to Georgescu-Roegen in the 70s to Herman Daly, Charles Hall, Cutler Cleveland etc. in the present day. This type of thinking - that energy is its own special input to the production function and is non-substitutable (we can't make stuff without energy), is still outside of mainstream economic discourse, who follow the classic exogenous growth model (Solow) where labor and capital are all that matter. But if energy is special, and has declining marginal returns (i.e. fossil fuel depletion), that has enormous implications for future growth prospects and the modus operandi for our institutions. Yet it is still widely assumed in economic/financial circles that energy is just the same as other commodity inputs and that a high enough price will create its own energy supply in perpetuity.

Incorporating the premise that energy is separate and unique in the production function is a necessary (but not sufficient) change we have to make to our economic theories. Professor Stern's paper, written for economists, is a step towards bridging the assumption chasm that underestimates energy's role in our human ecosystem. I invited David to write a short overview of his paper (guest post), which is below the fold.

Energy use has increased over time in close association with GDP both globally and in individual countries. This figure, based on World Bank data:

Figure 1 shows that the two variables also have similar fluctuations around the trend – the growth in energy use slows in recessions – which suggests that there is a real relationship between them. However, energy use has grown much more slowly than has GDP. This means that energy intensity – energy used per dollar of GDP – has declined steadily over time. When we look at a snapshot in a given year there is also a strong relationship between per capita energy use and income per capita across countries:

This leaves many unanswered questions:

Does energy availability and quality drive economic growth? Or is energy use merely a side effect of growth? Has the relationship between energy and growth changed over time? And what factors have reduced the energy needed to produce a dollar of GDP?

In a paper in this year’s Ecological Economics Reviews (a free working paper version is available here), I attempt to answer these questions in a review and synthesis of the literature on the role of energy in economic growth.

While physics shows that energy is necessary for economic production and, therefore, economic growth, the mainstream theory of economic growth, except for specialized resource economics models, pays no attention to the role of energy. Ecological economists, on the other hand, often ascribe the central role in economic growth to energy. I argue that criticism of mainstream economic growth models that ignore energy is legitimate, but theories that try to explain growth entirely as a function of energy supply, while ignoring the roles of information, knowledge, and institutions, are also incomplete.

As a step towards reconciling mainstream and ecological economics models of economic growth, I present a simple model that embeds the mainstream Solow economic growth model within a more general framework where energy and capital are poor substitutes. The model allows technological change to affect energy and labor productivity separately and differently so that we can distinguish between energy- and labor-augmenting technological change. In other words technological change that increases the productivity of energy and technological change that increases the productivity of labor.

The model shows that when effective energy - the product of the quantity and quality of energy and the level of energy augmenting technology - is scarce it will strongly constrain economic growth, but when effective energy becomes more abundant it is much less of a limiting factor and the conventional mainstream model explains economic growth fairly well. This explains why mainstream economic growth theory ignores energy – it is mostly designed to explain the last sixty years of economic history when energy has been abundant and cheap in developed countries.

Stern and Kander (2011) show that the growth of energy use and energy augmenting technological change were the main sources of growth in Sweden in the 19th and early 20th century. However, in the late 20th century labor augmenting technological change became the dominant driver of technological change. This explains the industrial revolution as a releasing of the constraints on economic growth due to the development of methods of using coal and the discovery of new fossil fuel resources.

This model also explains why the cost of energy as a share of the value of output fell dramatically over time as shown by this graph:

When inputs are relatively hard to substitute for one another (elasticity of substitution of less than one) a fall in the relative price of an input reduces its share of costs or income. This is what has happened to energy relative to labor and capital over two centuries in Sweden. Preliminary work by Kander and others suggests that a declining energy cost share is common to several countries.

Energy intensity has not only fallen globally over the last few decades as we showed above but has declined for at least 150 to 200 years in many countries including the United States:

The graph shows that when only modern commercial forms of energy are considered energy intensity follows an inverted U shape curve. But this is not the case when traditional biomass, muscle power etc. are considered.

The factors that have driven the decline in energy intensity can be grouped in the following categories:

–substitution between energy and other inputs

–technological change

–shifts in the composition of the energy input

–shifts in the composition of output

–structural change

The most important driver of reduced energy intensity appears to have been technological progress. More disaggregated data typically show a smaller role for technological change and a larger role for structural change. Shifts to higher quality fuels have also reduced energy intensity in some countries such as the U.S. but in others like China and India in recent decades or Germany and Britain in the 19th century, the switch towards coal has increased energy intensity, everything else constant.

It is commonly thought that the increasing share of the service sector in economic activity over time would reduce energy intensity but the gains from this are less than widely believed as the service sector still requires significant energy inputs to support the infrastructure of office buildings, shopping malls etc. Evidence also shows that trade does not result in reductions in energy use and pollution in developed countries through the off-shoring of pollution intensive industries.

The paper implies that future constraints on energy use would limit economic growth but reductions in energy use would not reduce living standards back to those of previous centuries due to much improved technology. The ultimate limit to economic growth in an environmentally or resource constrained world is how much we can continue to improve energy productivity. Though thermodynamics prescribes precise answers for simple processes, the ultimate limit at the macro-economic level is not clear.

Thanks, Nate, for getting this summary!

The conclusions at the end aren't really part of the original paper (which is really a survey of recent literature), and I find them on the "iffy" side.

It would seem to me that much more than improved technology would be required to make such a statement. It seems like one would need to be able to postulate that our financial systems can hold together with much less energy, or that we can get along without debtors being able to repay their debt with interest. See my post, The United States' 65 Year Debt Bubble.

This is one limit, but is it the only limit? Does't our current system have to hang together, as well?

Yea, David Korowicz' stuff addresses the other limits & sneaky dangers of popping key pieces out of a complex system:

See http://www.feasta.org/documents/risk_resilience/Tipping_Point.pdf

...as well as http://www.energybulletin.net/stories/2011-10-10/cusp-collapse-complexit...

Also http://www.youtube.com/watch?v=pmC1juUCygo

Gail - yes the whole system is interesting and obviously relevant. but not everyone can grasp the interplay of all the salient aspects (can anyone?). it will be a big step towards designing a more holistic system if economists understand/agree that the macroeconomic production function is dependent on energy. Period. To do that doesnt require bringing in finance and the other shaky aspects of our economic society.

I.e we need to see the whole picture but we also need people working on the parts...this post is either new or anathema for most practicing economists.

Nate, isn't the following a key point?

"it is still widely assumed in economic/financial circles that energy is just the same as other commodity inputs and that a high enough price will create its own energy supply in perpetuity. "

If renewables and nuclear can indeed provide adequate energy, then isn't the conventional assumption still valid??

Nate,

I'm continuously disturbed by our casting and framing of the question of economic well-being in terms of economic babble talk.

Then we inevitably fall into the trap of arguing about what "GDP" is or is not as occurs down thread.

Rather than talking in terms of dollars, perhaps we should talk in terms of the basket of unfettered promises that we expect a dollar ($1 US) to fulfill.

For example, maybe one of our underlying expectations is that a dollar will always buy us 7 miles of car-mediated transport.

(That implies that $4 will buy 28 miles of transport --assuming $4/gallon and 28 MPG).

Then again, we may have many other unstated but implied expectations about the unfettered promises that $1 US makes to each of us:

--how much of a loaf of bread that $1 promises to get us

--how much medical care/well being that $1 promises to get us

--how much entertainment or other pleasures that $1 promises to get us

--how much data processing (computer) power that $1 promises to get us

--how much of fresh or dirty air and water that $1 promises to get us

--etc.

You go, StepBack. At this point, the USD can be equated with $200+T in untenable promises to future US entitlements and some large part of the global derivative cache of $1.5?Quadrillion stuck in the off balance sheets of TBTF banks and other essential parts of our financial system. This compares to the world GDP of $65T. Money has no meaning at this point compared to the real underlying wealth of natural resources and production, especially since much of production is going to have to be reworked and relocalized. We're going to have to invent a lot of new terms, and a lot of economic terms are going to become passe.

"energy intensity – energy used per dollar of GDP"

And the reason energy used per dollar of GDP has waned is not that the underlying resources of the system have changed, but that "GDP," which is a measure of churn, has expanded as we expand the amount of debt, casino chips, bets, and useless paper swaps in the system over the past half century in this country. Our measurement system has gone wonky as too many people profited from gaming the system. Kurt Cobb's diagram of our distribution of production in the US below suggests why "GDP" is a very poor metric for an economy headed for permanent economic contraction due to declining nonrenewable inputs. Large portions of FIRE, government, business services, education, healthcare, retail, etc. are going to mostly disappear in what evolves out of collapse. That means that arguing according to metrics of either dollars or GDP is useless. Succumbing to the language and measures of the economists just gives them residual power over our dying system. And "Technological Progress" just means that we've spun up energy use (MPP). Technology is just a way to use more energy.

The use of economic terms, theories, and thinking creates upside-down thinking about how the world works. Ecological economists appear to spend too much time with economists, speak their language, and cannot be separated from them ideologically? Bobby Kennedy had it right a long time ago.

"Too much and too long, we seem to have surrendered community excellence and community values in the mere accumulation of material things. Our gross national product ... if we should judge America by that - counts air pollution and cigarette advertising, and ambulances to clear our highways of carnage. It counts special locks for our doors and the jails for those who break them. It counts the destruction of our redwoods and the loss of our natural wonder in chaotic sprawl. It counts napalm and the cost of a nuclear warhead, and armored cars for police who fight riots in our streets. It counts Whitman's rifle and Speck's knife, and the television programs which glorify violence in order to sell toys to our children.Yet the gross national product does not allow for the health of our children, the quality of their education, or the joy of their play. It does not include the beauty of our poetry or the strength of our marriages; the intelligence of our public debate or the integrity of our public officials. It measures neither our wit nor our courage; neither our wisdom nor our learning; neither our compassion nor our devotion to our country; it measures everything, in short, except that which makes life worthwhile. And it tells us everything about America except why we are proud that we are Americans."

Iaato,

Nice inverted iceberg chart.

Where did you get it from? {Citation please if you don't mind]

IMHO it is just the tip of the iceberg because, despite their claim to be "accountants" and to account for everything, economist actually fail to (intentionally) account for everything.

More to the point, they don't account for Bads and Disservices.

If we are going to have an ecological accountant's accounting for "Domestic Production", it should include all the bads and disservices we produce domestically.

That is part of what I was trying to get at when calling it "economist's babble talk".

GDP is not "gross". It is subtotal; and intentionally so.

Sorry, Step Back. I gave attribution but no link. I've been using the pyramid a lot lately to get my points across.

http://resourceinsights.blogspot.com/2007/07/upside-down-economics.html

And if you compare that inverted pyramid to the real system below (Tom Abel on Transformity), we've got a whole lot of morphing yet to occur to get back to a normal food chain hierarchy/distribution. Fossil fuels have a lot to answer for; stealing your opponent's game pieces will shorten the cumulative length of the game. Fossil fools only fool us into thinking we can do without ecosystem services and natural resources for a while. Then reality catches up, and the more we've stolen, the worse the backlash.

http://www.youtube.com/watch?v=n7Fzm1hEiDQ&feature=player_embedded

Thank you everyone for these comments. In this guest post I tried to provide a bit more context and interpretation than there are in the peer-reviewed paper. Regarding the role of the financial system in the sustainability of economic well-being - the financial system is a system of property rights and other institutions. Good institutions are important for promoting economic activity and are probably the main reason why some countries are poor and others are rich into today's world. On the other hand they can in theory be changed in a way that isn't true of the availability of natural resources or the state of our technological knowledge. Property rights can be changed. So this article largely ignores the role of institutions or rather just treats them as background.

"I argue that criticism of mainstream economic growth models that ignore energy is legitimate, but theories that try to explain growth entirely as a function of energy supply, while ignoring the roles of information, knowledge, and institutions, are also incomplete."

What's missing is an economics of scarcity. Energy wasn't ignored, per se. Rather, the model was incomplete because it ASSUMED resources are available in any quantity needed. Energy is no different than copper, aluminum or labor. We are now in a situation where the model boundary conditions are coming into play -- i.e. what happens when supply of ANY resource is constrained, and there is no good substitution?

Congrats on getting a step closer to a holistic model, but it still seems the folks in the peak oil community are only open to the ecological model. Just look at how you raised Gail's hackles (very predictably) over your anti "dark ages" prediction.

What concerns me in this kind of analysis is the reliance on the veracity of measures of output like GDP. Since some of the "values" aggregated under this rubric include money created by the financial system (i.e. not tied to real wealth due to its speculative nature) how can we tell that the relation between real physical wealth and energy use (as implied in the top graph) hasn't been much closer? Even allowing for increased real efficiency due to technology, I would not be surprised if the energy and "wealth" curves were much closer together than the energy/GDP curves indicate.

Reliance on measures like intensity are OK for correlation. But isn't it hard to derive causality when one of the numbers used is suspect?

[Caveat: I have not read the working paper, so the answer to my question might very well be covered in that.]

Hey George,

I just want to take this opportunity to emphasize that "physical wealth" does not have a 100% correlation with "subjective well being" aka "happiness". A quick search on happiness index delivers an interesting collection of web sites. The happyplanet.org site, in particular, provides some data visualizations of this theme with an environmentalist spin.

I think this is important because I am skeptical that we will "scare" people into changing their lifestyles with predictions of global warming or peal oil.

I would much prefer suggesting to people that they can be significantly happier after adopting a low-consumption lifestyle.

Best Hopes for Voluntary Simplicity.

Jon

Hi Jon,

Too true. Happiness does not depend on material goods per se.

Just to clarify, what I mean by "real" wealth is the accumulated physical assets of all classes of a society including all human biomass and human-managed biomass (e.g. pets!) All of this incorporates embodied energy directly from the amount of work that needed to be done to produce and maintain it. The human biomass may or may not derive psychological pleasure (or higher order happiness) from the other assets, though I argue they do satisfy a basic biological drive. It's just that it took energy to produce them. Since money and the value of transactions that feed into the computation of GDP has been inflated over time, irrespective of the actual production of all assets and biomass, I question the derivation of some causal relation (e.g. whether energy is a cause of growth or merely an enabler)

In fact I will go a step further and assert that growth of assets and biomass and growth of energy production were mutually causal, i.e. form a causal loop. This follows from the nature of all biological systems attempting to maximize energy resources (c.f. optimal foraging theory) with success leading to phenomena like overshoot (e.g. Jevons' paradox). We just happen to be more clever in our pursuits and found fossil fuels do the trick. So clever, in fact, that we could use formerly abundant energy sources to compensate for Leibig's law of the minimum and to fuel effective substitution of material resources.

While I'm at it I will also mention that I am skeptical of claims of efficiency increases contributing that much to decreasing intensity. There is a well documented phenomenon (related to Jevons) that a local increase in efficiency in a process is bought by a global increase in energy usage to support the technical improvement. In other words you can insulate your house to improve its thermal characteristics and save energy (and money) but the insulation manufacturing process may actually end up expending more energy per unit house served! Life cycle/whole systems EROI may, one day, demonstrate such phenomena. In general, a local optimization does not necessarily produce a global optimization. We need to be careful about using the Greedy method in decisions!

George

some of the "values" aggregated under this rubric include money created by the financial system (i.e. not tied to real wealth due to its speculative nature

That doesn't seem to make sense to me. Money supply and credit are generally understood by conventional economists to not be real wealth, and are not counted in GDP.

I took that phrase to mean the income generated by the "bankers" in financial manipulation that did not enable resources to flow to productive assets that created jobs/infrastructure/etc. Surely that is counted in the GDP, isn't it? And surely it concentrates wealth without improving the general well being.

Actually, if banking is done properly it's very valuable. Directing investment to the right projects is extremely valuable. Any activity, whether it's farming or banking can be done improperly and waste value. A big problem is that the US, and US citizens, are borrowing too much and producing too little - that's not the bankers fault (mostly).

Heck, the kind of speculation that brings future problems into the present is also very useful: we depend on the futures markets to alert us now about scarcity in the future. That's one reason why complaints about speculation raising oil prices is unreasonable: we want that to happen.

OTOH, I agree that finance in the US is out of control, and pulling in too much money which is paid out in excessive salaries, bonuses and dividends. That's classic capturing of government by a special interest.

I'm going to have to disagree here Nick. There is very little need for, and value from, banking in the modern world, despite what all the grand HSBC ads plastered all over everywhere would like us to believe. Fractional reserve banking was invented as a way to fund the European expansion and conquest of the rest of the world -- to facilitate rapid economic growth. Since continued economic growth is neither viable in most countries, nor desirable, we no longer have a need for fractional reserve banking. I'd argue that we have no more need for banking, period, at least in terms of supplying credit.

Banks do not invest anymore; what they now do is enable and promote misallocation of resources (ie, excess labour and increasingly scarce raw materials) into hopelessly misdirected pursuits to fund one ponzi scheme after the next, to skim wealth off from the middle class through defaults when those bubbles crash.

And the fact that in the US citizens are borrowing too much and producing too little (this isn't entirely true because actually US citizens have started to save more, and the banks aren't lending the trillions the Fed is handing over to them) is indeed almost totally the bankers' fault. Banks own the Fed and the Fed sets interest rates and therefore controls which bubble will next inflate and pop. And it is bankers that institute and manage currencies, and therefore it is the bankers who have set up the ponzi scheme to inflate the dollar and suppress the Yuan and subsequently fuel the catastrophic transfer of productive capacity from the US to China; so in this respect bankers are almost entirely responsible for the lack of "production" by America. Without this banker currency manipulation, on a level playing field, the Yuan would have long ago appreciated in value to offset the industrial gains China was making and the dollar would become more competitive, and America would retain some of its former glory as a manufacturing superpower (although I also have to lay blame on the luddites in American industry -- just look at the opportunities squandered over the years by the suppression of the electric car movement and the unfair subsidies granted to the oil industry)

If anything, I would presume that speculation (by the Fed's arm's length banks) is driving oil prices down.

We really have no need for banks anymore (I'd argue we never really did), other than as a depository to store our money so that we don't have to walk around with it in our pockets. We would all be just fine if there were no longer such things as bank loans, because we no longer need to produce more stuff. If and when the economy stops growing (it already has) then why would we need new loans to go buy new houses? Why not buy existing houses?

It is both. Asia and Africa is transforming rapidly, for the good of their peoples.

Loans are a very nice way to let people even out consumption over their life times, and to enable new businesses to flourish and compete (otherwise, people with ideas and drive would have to find and subordinate themselves to rich companies that are willing and able to take them on.)

This is not true. Banks do what they can to fund sound businesses and people, and overall, they do it quite well, the latest financial crisis notwithstanding.

1. America's production has increased all along, it's just that productivity has risen faster than production, so you've lost jobs.

2. The Chinese decide this mostly by themselves, and you should be glad you can convert green paper into nice goods. It makes you all a lot richer.

3. The yuan is appreciating, Chinese wages are increasing and production is starting to move back.

The global economy is growing fast, and America will pick up eventually too. Internal migration patterns and increasing population, as well as some houses getting to old and shabby, necessitates building new houses.

"It is both. Asia and Africa is transforming rapidly, for the good of their peoples."

We'll see how "good" that growth is for their peoples when Peak Fossil Fuels becomes more apparent... I tend to believe that ponzi schemes appear to be good on the upside of the bubble, but then they "disappoint" when everything inevitably crashes...

The productivity of the planet is like a pie chart -- technology is not increasing the size of the pie chart, but rather preventing it from crashing by using fossil fuels to cover up the damage we are doing. What happens when those fossil fuels run out? What happens when the environmental impacts of all of that fossil fuel use become apparent? What happens when technology gains cannot further artificially inflate the pie chart due to technological limitations? (for example, the limits in agricultural productivity we have hit with many crops -- it doesn't matter how much more fertilizers or pesticides we throw down, wheat and rice have basically hit their limits -- maize still seems to have some opportunities for improvement but this requires further fossil fuel input).

"Loans are a very nice way to let people even out consumption over their life times, and to enable new businesses to flourish and compete (otherwise, people with ideas and drive would have to find and subordinate themselves to rich companies that are willing and able to take them on.)"

Only within the framework of the current monetary system. That monetary system is fundamentally flawed because it is based on debt and usury, and this requires perpetual growth to function. When growth stops, the middle class is the first to lose out. It also throws everyone into a situation of artificial scarcity (P + I at the top is greater than P at the bottom), which then forces the middle class into debt slavery and effectively operates as a siphon to skim off excess wealth from the working class. This monetary system will soon end because growth cannot continue and there is no more middle class wealth left to skim. If wealth and control were restored to the middle class with a new monetary system based on interest-free and debt-free money issued by the government then banks would no longer exist to force everyone into artificial scarcity and debt slavery.

"Banks do what they can to fund sound businesses and people, and overall, they do it quite well, the latest financial crisis notwithstanding."

Agree to disagree.

"1. America's production has increased all along, it's just that productivity has risen faster than production, so you've lost jobs."

Production of what? Corn? How can losing the majority of the world's manufacturing base lead to greater production? And a lot of those supposed increases in production are statistical tricks where they understate inflation which then directly results in the overstatement of GDP.

"2. The Chinese decide this mostly by themselves, and you should be glad you can convert green paper into nice goods. It makes you all a lot richer."

Yes, Chinese bankers decide this... And if I was American I would definitely not be glad that I could convert pieces of worthless green paper over into nice goods, because I am aware that this is the result of greatest ponzi scheme in history which will soon end catastrophically -- I would much prefer that the money I had in my wallet was part of a legitimate monetary system that wasn't part of a scam to steal the wealth of my country and to enable me and 300 million others to consume more stuff at absurdly low prices when the planet is running out of the resources needed to make that stuff, hiding the true price signals that should be stimulating economic efficiencies, and destroying the planet in doing so.

"3. The yuan is appreciating, Chinese wages are increasing and production is starting to move back."

Yes, but domestic Chinese inflation is rising faster.

Very nice set of comments, Null; some systems thinking with no economic parseltongue. I'll repost two comments from Gail's post at her blog on the US's 65-year debt bubble that apply here as well, to put a theoretical spin on it.

http://ourfiniteworld.com/2011/10/10/the-united-states-65-year-debt-bubb...

The Maximum Power principle (MPP) says that “you can’t play for long unless you steal your opponent’s gamepieces.” And after the 1970s, and due to the US’s powerful momentum, oil prosperity, and military might, we did just that, beginning with Reagan. Through the IMF, World Bank, and other organizations, we manipulated the global currency system and achieved petrodollar status so that we could continue to expand our monetary system through expansive international loans, putting poor countries in debt to us so that they were forced to sell their resources to us at a disadvantaged “distress sale” rate. In other words, the system self-organized into a design where the US, already in power, designed new feedback loops to bring in even more power. The MPP basically says that in a situation with surplus energy, them that has typically get more. The MPP as a proposed fourth thermodynamic law explains what the second law doesn't; how energy concentrates, in contrast to how it disperses.

In descent without surplus energy, the positive autocatalytic loop stops working, and more cooperative, efficient system designs win out. Yes, dropping oil production/importation will mean less employment and eventually more strife, unless the government pulls an FDR and redistributes jobs. Since we are part of the way into corporo-political collapse, I don't think that's possible, because of all of the regulatory capture. (Orlov divided "commercial" and political collapse into two stages because of his views of the Communist collapse, but I don't think we can divide the two in this country.)

http://www.nytimes.com/imagepages/2011/09/04/opinion/04reich-graphic.htm...

GDP measures churn in the economy, so the last two decades has been devoted to a self-amplifying spin-up of the financial, insurance, and real estate industries, bolstered by paper-trading on Wall Street. The graph at the link above suggests that the real economy separated from the FIRE economy around the same time the global per capital oil production peaked, and Reagan declared a new dawn in America based on borrow and spend.

The link below illustrates the MPP, Klein’s Shock Doctrine, or Predatory Capitalism, depending on what you want to call what we’ve done here. You can’t play for long unless you steal the other players’ gamepieces.

http://ukiahcommunityblog.wordpress.com/2011/02/16/predatory-capitalism-...

Which leads to the proposed fifth law of thermodynamics–Transformity. You shorten the cumulative length of the game the more you steal. The levels of hierarchy that we have built up in our amazingly complex system demand a new magnitude of energy inputs at each level. The higher we build it, the more impressive the downfall–kind of like the game Jenga. Fossil fuels have allowed us to winnow out our resource basis and expand our population as we borrowed more and more from overseas. The system gets more and more skewed and dependent on fossil fuels. Graceful descent then becomes less and less likely the further we go.

http://syzygyastro.hubpages.com/hub/Transformation-of-Energy-Principles

Fossil fools.

Illustration of the autocatalytic loops from Domhoff. It gives great credit to Nate who voluntarily stepped out of this arena. With awareness, we can choose to stop playing the game and adopt a different set of values.

http://sociology.ucsc.edu/whorulesamerica/power/investment_manager.html

You calling things "ponzi schemes" doesn't make them ponzi schemes.

That's a very strange thing to say.

Then we transition to other sources of energy.

That's an extreme luxury problem - to have perfect knowledge and perfect utilization of that knowledge. Stuff for sci-fi novels.

I've recently read chickens grow three times as fast and consume a third of the energy compared to the 50-ies. Mostly this is due to genetic factors. I don't think we are done improving crops and animals. Also, we are definitely not done deploying high-productivity agricultural practices throughout the world. And finally, agriculture is no problem at all - the sector has almost no employment nowadays.

No, it does not require growth to function.

This is ideological rethoric, not economics.

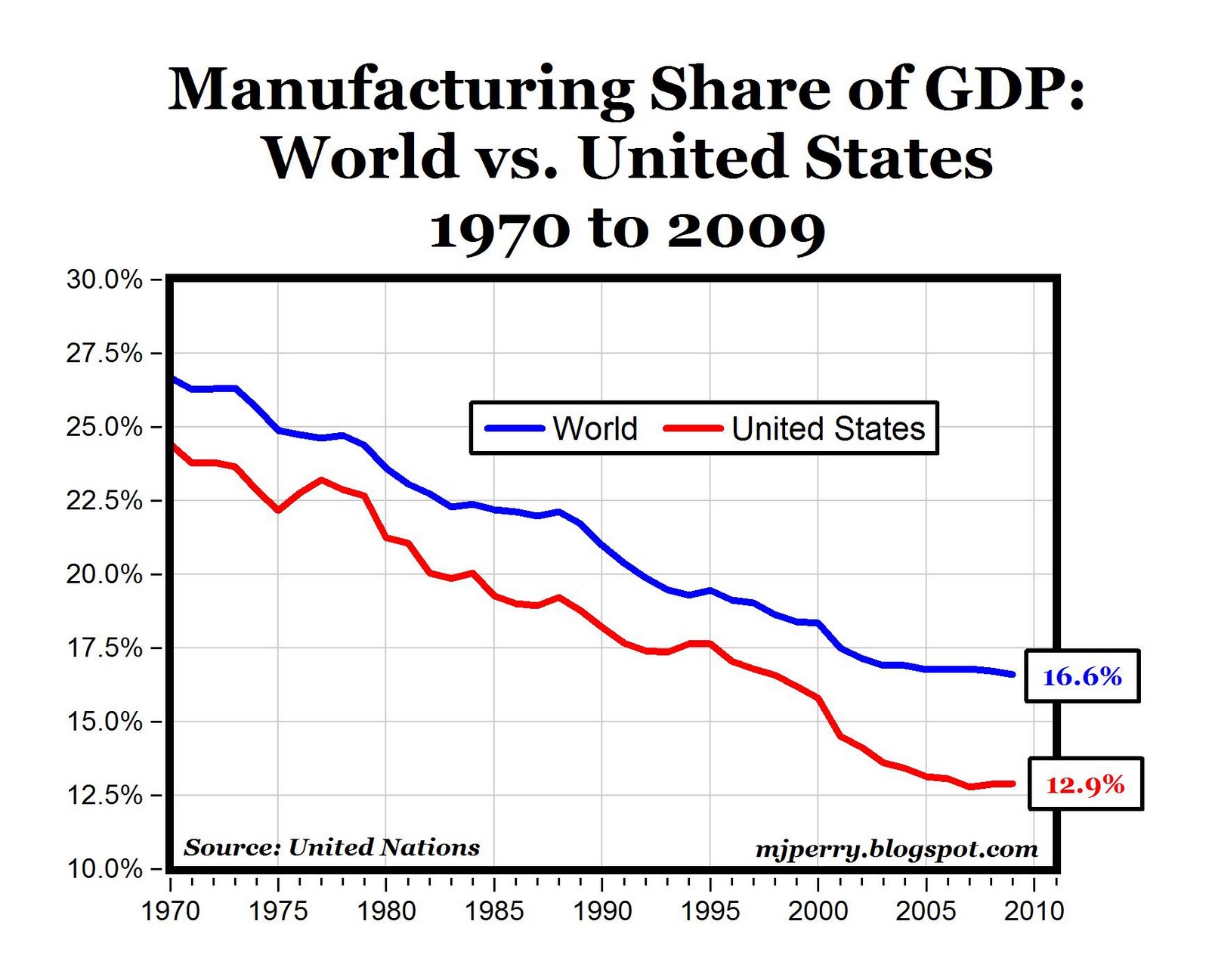

First, you're manufacturing more than ever. Second, the decline of manufacturing is a global phenomenon:

Third, regarding inflation, I think it's rather the other way around.

Steal by giving stuff away? Strange.

Yes, in the article I take the official GDP measurements for granted and don't get into all the issues about to what degree GDP drives actual economic well-being or happiness. These are all important issues, but my focus is on the potential role of energy in traditional growth theory.

GDP doesn't include the value of money etc. It is the value of all goods and services produced each year or all incomes received.

This is related to one of the things that I wonder about every time I see a discussion of GDP/energy. It seems to me (logically, and seemingly supported by some of Steve Keen's work) that GDP is essentially the sum of production and the change in debt. However, it seems like the change in debt is not clearly related to energy in that it involves the instant creation of fiat debt-based money. There's no energy input to this GDP component and, therefore, no energy constraint on this component's ability to increase (although other constraints likely do exist...I hope).

I think it would be interesting to see a version of figure 1 that adjusts GDP by removing the change in debt component. My gut feeling is that the correlation between energy and the productive economy (goods and services) is actually tighter than what is implied by figure 1. It just seems like the divergence in the energy and GDP lines corresponds pretty coincidentally with the massive increase in leverage we've seen in the last few decades. I'm sure that technology and knowledge improve energy efficiency/productivity over time, but I'm not sure that the degree of improvement is as significant as implied by figure 1.

Like I said, this is just a feeling, and I could easily be totally off base. I'd love to have somebody do the graph and/or have somebody conversant in Keen's work comment.

GDP is essentially the sum of production and the change in debt.

GDP is supposed to be "production" and only production. I've tried reading Keen's work, and found it....opaque. As far as I can tell, change in debt should not be involved except as a measurement error, or as a kind of shadow/reflection of the real economy.

Steve Keen is wrong on this, if that's what he said. GDP = total net domestic production = total income from domestic production = total net expenditure. The latter is the famous C+G+I+Net Exports.

You can't make sense of how much profit your small business produced last year when you leave out the $100,000 that you borrowed to cover your operating costs. Leaving out the increase of the national debt skews the data to put it mildly.

And if it's not already factored in, the effect of real (not official CPI) inflation would be heavy too. We're talking about the last several decades here.

Correct, your profit takes out the interest you paid on your loan. This net profit is the value added that is counted in the GDP.

There is a lot of controversy about what is the correct way to adjust for inflation. Adjustments to the US stats have reduced the measured inflation and as a result increased the estimated economic growth. This then affects how much change in energy intensity we see.

GDP isn't about profits. GDP is about production. Leaving out debt in production figures leaves ... production figures.

I don't understand Keen either, but is he, Keen, trying to get his head round the notion that 'debt' drives growth of GDP during a period of increasing labour productivity (e.g. petroleum-enabled averaged productivity - a period when it was sufficient to 'just invent the tools' and find uses for 'surplus labour'), and then during a follow-on period, 'debt' temporarily drives consumption, as in advanced economies in the last decade, also raising GDP? Then we reach a stage as now, when 'debt' can no longer be 'rolled-over', and must contract, and GDP declines?

Keen argues that a change in debt contributes to GDP. If you make $100 in income and borrow an additional $10 then you have $110 to spend.

Keen also argues that the change in GDP is a primary driver of employment because companies hire when they see an improving trend.

Therefore, employment is linked to the acceleration of debt.

Sure, debt is related to GDP, but that doesn't mean the two things are the same thing.

Just because something helps GDP grow doesn't mean that it's part of GDP.

If the President goes on television and tells everyone to go out and spend their savings instead of putting in the mattress, that will help GDP. That doesn't mean that we count that speech as more than whatever a few hours of presidential time normally contributes to GDP.

I need to read more of the great links posted here but I think in functioning markets any excess accrued debt would be factored into GDP through subsequent rising interest rates and slower growth. But today we don't have functioning markets, what we have is farcical absurdly low interest rates, about 1000000 X lower than what they should be based on fundamentals, allowing debt to be piled onto debt in the final throws of the longest lasting fiat currency in history -- about 40 years. We now have complete market manipulation from central banks printing money to buy further debt, with the resulting inflation being hidden by 1) near zero interest rates, and 2) deflation from a collapsing economy. So prices aren't going up nearly as high as they should be, but still significantly. This is stagflation.

We also have a totally screwed up global system of trade and reserve currencies (the dollar being the prime example, followed by the Euro) which are held as assets by other countries (China up to late), thus artificially inflating the value of those currencies and conversely artificially suppressing the purchasing power of Renminbi by not allowing it to be held as a reserve currency. Basically -- the greatest ponzi scheme in history, where no numerical financial analysis based on "fundamentals" can have any real relevance.

Plus the official CPI inflation numbers have become increasingly fantastical over the last few years as the government tries to hide its printing of 20 trillion dollars to bail out the derivatived-out financial system. So I think the apparently improving GDP-to-energy-used ratio, based on the official numbers, may be wildly overstated since GDP is now significantly overstated.

And a decreasing overall EROEI would also tend to drive this ratio back down. I don't see average gas mileage improving that much just yet but I do see an EROEI of about 1 or 2 for the Alberta tar sands, with a quarter of Canada's natural gas production going straight to Alberta just to turn tar into oil.

Assume a house is sold during a housing bubble for $100,000 more than the previous price, with borrowed money, by the buyer.

If this is counted as GDP, then it seems to me that the increase in the value of the transaction and the borrowed money are part of an increased GDP and little energy is expended for it.

It isn't counted as GDP.

The sale of a house is not counted as GDP? I do not understand why not.

What other items are not counted as GDP when they are sold?

Gross Domestic Product measures what has been produced; simply shuffling ownership from one person to another doesn't produce anything, and so doesn't contribute.

It couldn't be any other way, really - having two people sell the same house back and forth between themselves 1000 times doesn't produce anything of value, so it's correctly noted as not contributing to the economy.

(Note that services are considered part of GDP, so a realtor's time spent facilitating a sale would add to GDP, based on my understanding.)

All of them. GDP is about what gets made, not what gets sold.

Note how inventories affect GDP; producing goods and sticking them in a warehouse counts towards GDP, so those goods are not counted a second time when they're taken out of the warehouse and sold.

GDP is about what gets made, not what gets sold.

Well, that is oversimplifying a bit. I think it is more accurate to say it is what gets made, that is intended for sale

From you link on "produced";

So what happens when something is produced, but never intended to be sold, and is never recorded as an "inventory"?

For example, if I put some solar panels on my roof, and offset half my energy consumption, the amount of energy produced and sold but the electric industy is reduced by the same amount. But there is no way for the official figures to account for what I have produced, so the official GDP number is decreasing.

Same if I grow my own tomatoes, or decide to bake my own bread. The same amount of flour is still being consumed, but there is now one less loaf being sold(and reported) each day, so GDP is again decreasing, even though total production has remained the same.

So, I would say GDP is about what gets made, that is intended for sale. This is why many third world countries have artificially low GDP. If every household grinds their own grain, bakes their own bread, grows their own vegetables, instead of buying them all from someone, the GDP numbers are much lower., even though the exact same amount of food is being produced.

I will concede that in a western economy the amount of home, or unrecorded production (the "cash economy")is very small in relation to the official GDP, but still, GDP is an imperfect measure - except in the economists idealised world.

As more people grow their own food and produce their own energy, and do work for cash, we will see apparent decreases in GDP (and tax revenues) and worried politicians, but it doesn't necessarily mean that people are eating less - just that they are using the politicians accounting system less. And, really, who can blame them?

Good point Paul. This is why our governments and banks really don't want the average person to become energy self sufficient and (more) food self sufficient, because then they'd be buying less stuff and therefore tax revenues would dry up. They want and need us to become increasingly dependent on buying stuff. Without this dependency the western economies would collapse because the US economy is based 70% on consumption.

It's a fundamentally flawed system where the economy will collapse unless products (and therefore the resources needed to make those products) are consumed in exponentially increasing amounts. It literally is a ponzi scheme. We're damned if we do and we're damned if we don't. If we don't consume and instead all become better conservationists and ride our bikes around everywhere then the monetary system collapses. On the other hand, if we continue consuming on this exponential trajectory dictated by our monetary system then ultimately resource depletion will destroy us in a final Malthusian catastrophy. And ironically when this collapse happens we will all be DEpendent on that very system, not independent, and therefore even less prepared to fend for ourselves when the system stops. It is insane and amazingly, the vast majority of people out there truly believe that the way to help the economy is to "buy more stuff". Ummm, no ... that's "how to inflate a ponzi scheme".

This is why our governments and banks really don't want the average person to become energy self sufficient and (more) food self sufficient, because then they'd be buying less stuff and therefore tax revenues would dry up.

IIRC there was a point in European history when it was illegal for the average person to own a flour mill.

Only the landed gentry were allowed to own a flour mill, and every person who brought grain to be ground was required to hand over a significant percentage of it as taxes (or payment for the grinding "service").

Resource capture, enclosure, extortion. The song remains the same.

Gross Domestic Product measures what has been produced

Here I think is the most profound error of all -- not pointing fingers at OP, but at the common parlance of our times.

Nothing is "produced" by human industry. Matter is not created. Matter is transformed -- generally from a low-entropy to a high-entropy state, from potential usefulness to "waste". Energy is consumed -- that is, dissipated or dumped into a sink which in turn has limited absorption capacity.

When we talk about oil "production" for example, we kid ourselves. No one is "producing" gasoline: we are consuming reserves of crude oil, and we are spending more oil to transform the crude oil into more useful refined products like gasoline. Similarly, when we produce houses we destroy (among other things) trees -- often entire mountainsides' worth of forest, often with collateral damage that includes whole watersheds, accumulated topsoil, etc. We don't "produce" anything. The food/sunlight web creates biotic wealth; original planetary/volcanic/tectonic activity concentrated mineral ores in certain locations from which we remove them; millennia of biotic wealth were compressed/concentrated in locations from which we remove them (in the form of oil and coal). But we "produce" nothing, we just move stuff around and expend energy transforming it into other stuff.

We use the word "produce" as if we produced a rabbit out of a hat -- creating something from nothing. This is one reason why economists remain blind to "externalised costs" (the destruction and high-entropy outputs of our "productive" activities) -- the word itself obscures the underlying physics. We say "coal production is up" without having to remember or admit that what this really means is "coal destruction is up" -- we are burning it, transforming it into a high-entropy output which cannot be reconstituted (on any time scale meaningful to our civilisation anyway).

The only thing that "produces" is plant life, and even that is really transformation: capturing solar energy (plus trace amounts of minerals) and transforming it into sugars, etc. Only because of that transformation (capturing an external-to-the-planet energy source and transforming/concentrating it) can plants multiply, "producing" more plants which in turn are consumed by animals which "produce" more animals. Remarkably, the food web manages to re-use its "waste" outputs seamlessly as inputs -- they are reconstituted, after several stages of microbial activity, as more plants. To put it in cartoon form: Bear shit turns into trees. Trees stabilise soil, capture and respire water, provide shade and enable permanent stream and river formation. Appropriately shaded streams and rivers harbour recurrent salmon migrations. Bears eat salmon. Bear shit turns into trees. Closed-cycle reprocessing. The food web is able to produce a surplus each year (animal populations and species diversity grows towards a climax ecosystem), but that surplus can never be more than the energetic content of a year's worth of sunlight each year. Localised negentropy, but no miracles (unless you count the remarkable, crazy niftiness of life itself).

Burnt coal, however, doesn't turn back into more fresh coal. Combustion is just plain entropy, with no neg about it.

Basically, our planetary budget consists of a fixed quantity of minerals and rocks [modulo the occasional and relatively trivial addition of meteoric arrivals], plus a relatively fixed quantity of water, plus a remarkable assortment of evolved micro and macro flora, plus a yearly allowance of solar energy which the flora can capture and transform to make it directly available to other flora and herbivores; large carnivores live on the surplus of two layers of mediation between them and sunlight; but all biotic existence on the planetary surface is predicated on the transformative activity of plants and the external input of sunlight. [1] Humans are consuming more and more of that surplus, plus drawing down the fixed capital of minerals and accumulated "savings" of previous biotic activity. That's what we mean when we talk about "production".

There really isn't anything else. Everything we call "production" is actually destruction/transformation of some other resource, with associated dissipation of energy. We don't produce. Plants and micro-organisms produce, or rather, transform received sunlight into a modest annual biotic surplus. We live off that surplus. I wish we could stop talking about "production" and start talking about "extraction," "combustion," and "transformation." But that would mean outing the man behind the curtain.

[1] I qualify "surface" here because of the strange and interesting critters living around the "black smokers" far from sunlight on the ocean floor. they're chemoautotrophs, harvesting energy from the hot core of the planet, another fixed quantity established during planetary formation. the food chain is similar though: micro-organisms as the basis, with a pyramid of heterotrophs built on their transformative activity.

Which is why we need to live off of current solar income (wind, solar power, hydro, wave, etc) with some nuclear, perhaps; and recycle our captured mineral wealth.

That will work: current solar income is 100,000 terawatts, far more than the roughly 12-20 TW humans currently capture for their use.

The amount of sunlight is somewhat irrelevant. What is relevant is what proportion of that can humans safely divert for their own use. Similarly for drawing energy from the indirect sunlight of earth's other energy systems, and for damming rivers for hydro. There will be an impact no matter what we do but we need to ensure that impact is as minimal as it can be and still give us a reasonably happy and satisfying existence.

Remember that 100% of the sunlight that falls upon this planet and is not reflected back, is currently employed in sustaining life and powering the earth's energy systems, and those energy systems have some use for maintaining our current climate and environment. Of course, we're now altering things somewhat but you get the idea.

I think science is only now starting to look at how much energy we can safely divert.

Then start with that which falls on roofs. Cuts down on distribution infrastructure too.

NAOM

100% of the sunlight that falls upon this planet and is not reflected back, is currently employed in sustaining life and powering the earth's energy systems, and those energy systems have some use for maintaining our current climate and environment.

A large percentage of the sunlight that falls upon the planet is simply reflected. If we change the albedo of the earth slightly with PV or CSP, it's pretty trivial to adjust for that by changing the albedo of other human infrastructure.

Similarly, a large percentage of the sunlight that falls upon the planet is very, very quickly turned into heat. Capture of some light with PV or CSP and then into space heating, EV power or lighting simply delays that transformation for a few hours.

The percentage that is used by vegetation is well below one tenth of one percent. We're not in much danger of hurting the earth's ecosystem by using solar power.

A new house sale is "production". That's part of GDP.

An existing house sale is not production (it's just property changing hands), and isn't part of GDP.

That makes no sense.

What if I buy a fixer-upper house (a dilapidated one), fix it up and sell it?

Haven't I "produced" something that wasn't there before (the fixed up house)?

You have, but it isn't measured if you do it in your spare time (except for the stuff you buy to do the job, of course). If you employ professionals to fix it, their work will be included, but most non-salaried production simply isn't captured by GDP.

Thank you for your explanations. It makes me wonder how the costs of production of many things are determined in GDP.

For example, how do they know how much the builder paid for the lot and building materials? From what you indicate they should not be a part of GDP for the production of a new house.

If it is the profit that is counted as GDP, how does a bubble of inflated sales price fit into GDP?

And how does it get counted if the builder has to sell at a loss?

The whole thing is a farce.

However, with the right dosage of mental manipulation and with clever choice of a cool-sounding label (brand name) as well as a 3-letter acronym, "G-D-P", the thing is given the illusion of legitimacy.

You can get to GDP in three different ways and in principle the result should be the same: You can sum up a country's production, its incomes or its expenditures. Yields the same result.

The expenditure method goes by the formula:

GDP = private consumption + gross investment + government spending + (exports − imports)

A common way of calculating GDP by income is:

GDP = compensation of employees + profits + taxes less subsidies on production and imports

And by production:

GDP = Value of output – Value of Intermediate Consumption

There's a number of variations of the formulas, of course.

Great paper and good comments. Taking into account the energy transformity (quality) between FF's and electricity was brought up in the paper and may be an even larger factor in explaining the divergence of these GDP vs Energy curves.

Thanks for this post.

Figure 4 showing how including traditional biomass transforms the 'rise and fall' picture of Energy/GDP ratio is very important.

Angus Maddison was one of the few people to stick his neck out a give some estimates of global traditional biomass use. Everybody else just seems to have ignored it.

But traditional biomass is still very important in developing countries and perhaps there are lessons to be learned from the past on how the Energy/GDP ratio can be improved without the use of fossil fuels.

BobE

A few observations / questions from Figure 4. The inflection in modern fuels around 1920 - is that the ICE kicking in? During WWII efficiency seems to have ticked up significantly - domestic energy savings in favor of wartime production? And post WWII traditional fuels play no part in generating GDP - there is a message in there somewhere I think?

Finally, on current trend, by 2070 we won't need energy to generate GDP.

During WWII efficiency seems to have ticked up significantly

Either GDP went up, or energy consumption went down. I'd say partly because GDP increased because WWII followed the Depression, but probably mostly because domestic consumption fell: the US was sending some of it's oil to both it's allies and it's own overseas armed forces, while suppressing domestic driving.

"on current trend, by 2070 we won't need energy to generate GDP."

Perhaps there will be neither energy nor gdp? '-)

Is there any hint of a curve setting in that would extenuate that possibility indefinitely?

BobE

Interesting point.

EDIT Figure 4. for the USA can be illustrated by examples from farming both in USA and UK, and even more recently farming across much of Europe. I explore a little how these changes might differ or compare with changes taking place in Asia and elsewhere.

In living memory near my house in England, 27 pair of Shire horses on one large farm did most of the farming, fuelled on local biomass. In USA Peak Horses on the Great Plains was in the 1920s.

(Increasing 'horse-productivity' had been obtained fairly frequently by invention of new 'apps' over the preceding 180 years.)

On the other hand, petroleum 'horse-power' and synthetic N fertilizer use both more than doubled in 4 years in UK during WWII (50% more plowed land with only 10% extra agricultural workers), followed by a period in UK from 1960 when grain yield per cultivated acre doubled, and the agricultural work force fell markedly.

I do not pretend to properly understand the economics of substituting hand labour on the farm by horses or petroleum fueled machinery. EDIT Substitution by horses was and is not applicable in many traditional comparatively high-yielding areas, e.g. in China, and other highly-populated parts of Asia where yield per hectare and yield per person have both been increased substantially in recent 4 decades by N fertilizer application. These gains in yields per person have not been secured until very recently by introduction of very much machinery. If petroleum fueled machinery substitutes for hand labour the 'surplus' human labour must both find employment and 'consumption' elsewhere? Very tense situations, only partially resolved, are developing in the vast majority of the world that is not 'us'?

A number of fascinating points.

First, we see that OECD industrialization was not based on "cheap energy". Figures 3 and 4 make it quite clear that energy was much more expensive before WWII. Energy could become significantly more expensive than it has been in the last 40 years without endangering our economies. Wind and solar (and nuclear) are much cheaper than pre-WWII fossil fuel energy, and only slightly more expensive than the cost of post-war FFs when FFs were at their post-war cheapest. So we can shift to new energy sources without endangering our economies.

2nd, " Evidence also shows that trade does not result in reductions in energy use and pollution in developed countries through the off-shoring of pollution intensive industries." In other words, falling energy intensity in the OECD is not due to outshoring.

3rd, effective use of energy (aka "work", or "exergy") is important, but primary energy inputs...not so much. IOW, efficiency is more important than the volume of coal, or oil, etc.

4th, "when effective energy - the product of the quantity and quality of energy and the level of energy augmenting technology - is scarce it will strongly constrain economic growth, but when effective energy becomes more abundant it is much less of a limiting factor". Currently the OECD in general and the US in particular can be come much more efficient - this means that there is a lot of "slack", or reserve, available to power a transition to new forms of energy.

5th, that quote just above also means that our economies are not tightly controlled or determined by FF inputs.

Nick

Re: "Figures 3 and 4 make it quite clear that energy was much more expensive before WWII."

That does not follow. Please read more carefully.

The graphs show historically energy was a much higher portion of GDP (or a higher fraction of personal income), NOT that it was "more expensive" in real dollars.

e.g., See James L. Williams' Oil Price History and Analysis

The real price of oil was about flat near $20/bbl for 100 years from about 1876 to 1974. as well as between about 1984 to 2002, the first and second major OPEC caused oil crisis periods.

Nate,

1) the fact that energy pre-WWII was a much higher portion of GDP means that it was a much heavier burden on the economy. If wind and solar are a little more expensive, that means that the wind/solar sector has to be a little larger than otherwise to power the rest of the economy. This analysis suggests that this is not a big deal: that sector would still be a much smaller portion of the economy than pre-WWII.

2) the fact that oil's price was pretty flat pre-1974 is irrelevant to most of the history of US industrial growth, as oil was unimportant before WWI, and especially before 1900:

US 1900 5% of energy from oil:

oil: .4 quads (174k bpd @5.8Mbtus/b)

coal 7.2 quads (275M tons/yr @26Mbtus/ton)

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS2&f=A

US 1913 10% of energy from oil:

oil: 1.4 quads (681k bpd @5.8Mbtus/b)

coal 14.6 quads (560M tons/yr @26Mbtus/ton)

Re: "pre-1974 is irrelevant"

The actual data shows a continuous rapid growth.

Tad Patzek "Peaks"(Slide 19) where he shows US Oil production grew 9.1%/year for 80 years from 1870 to 1950

The actual data shows a continuous rapid growth...US Oil production grew 9.1%/year for 80 years from 1870 to 1950

Yes, but it started at a very low level, right? Again, oil was only 10% of US energy consumption as late as WWI. The US started the industrial revolution many, many years before that.

--------------------------------------------------

I'm fascinated by the presentation, which is from 2006. Take a look at page 26, where we see that by 2011 natural gas production was going to fall off a cliff! I'm reminded of Hubbert's analysis in the late 1970's, which also predicted that NG would fall off a cliff: in the 1980's!!

Also, see page 20, which entirely fails to anticipate the recent reversal in the decline of US oil production.

I think we can see some limitations to Hubbertian analysis here...

"The US started the industrial revolution many, many years before that."

Just to be clear: The industrial revolution started in the English midlands at the beginning of the 18th century, almost 100 years before there was a "US"

How about ""The US started it's industrial revolution many, many years before that."?

Nick

Re: "5th, that quote just above also means that our economies are not tightly controlled or determined by FF inputs."

That is wishful thinking, not supported by the evidence. Stern only says that some reduction is possible in energy per GDP.

e.g. an electric fluorescent lamp or LED light is much cheaper and uses much less primary energy per light output than a kerosene lamp. See:

Technical and Economic Performance Analysis of Kerosene Lamps and Alternative Approaches to Illumination in Developing Countries Evan Mills, Energy Analysis Dept. Lawrence Berkeley National Laboratory June 28, 2003

i.e. technological advance can reduce energy per physical output. However, when energy use drops below that improved relative technology level, you loose the service provided by the energy.

See Robert L. Hirsch, The Impending World Energy Mess for further perspective on the consequences of the loss of transport fuel, showing that GDP will likely decline in direct proportion to declines in transport fuel in the near term.

If fossil fuels are replaced by renewable transport fuels then yes it is possible to decouple from fossil fuels - but not "green energy" per say - which is commonly pushed as electricity, and almost all cars do NOT run on electricity.

Stern only says that some reduction is possible in energy per GDP.

He says quite a bit more than that. He says that GDP has grown much more quickly than energy consumption. If "some reduction is possible in energy per GDP", then some increase in GDP is possible while keeping energy consumption flat or falling.

Hirsch's analyis is enormously superficial - he provides no evidence at all for the idea that GDP will likely decline in direct proportion to declines in transport fuel in the near term. It's obviously wrong: the US has reduced it's consumption of oil by 10% in the last 4 years, while GDP has grown. And that's not due to off-shoring: the world's GDP has increased quite sharply since 2004, even while oil consumption was pretty flat.

The average US car gets 21MPG - new US cars get more than twice that without even going hybrid. It's perfectly obvious that the US could reduce it's oil consumption sharply while still growing economically.

Re Hirsch "provides no evidence"

Only because you have not studied his presentation: e.g. see

Hirsch ASPO 2010 keynote: Slide 12

"while GDP has grown."

Only because of inflation.

Real GDP declined 1% from 2007 to 2010

See US Bureau of Economic Analysis

Current-dollar and "real" GDP (Excel)

Try being factual in your arguments.

Only because you have not studied his presentation

Oh, I've studied his reports in detail. That's where the devil is.

Now, if we look at slide 12, we see a loose correlation. Correlation is not causation. Have you ever looked at the same chart, but looking at copper instead of oil? You'll see an even closer correlation.

Real GDP declined 1% from 2007 to 2010

Yes, US GDP declined from it's peak, and it had not yet recovered back to that peak by 2010. But, that's not the period I referred to. I said: "the US has reduced it's consumption of oil by 10% in the last 4 years, while GDP has grown. "

And, that's true: US GDP has now recovered to a level above that of 2007.

So, please try to be more attentive to detail and up to date in your arguments. Or...we can avoid entirely comments that seem to be veering towards the personal....

While we're on the topic, it's worth noting that US Net Imports have declined even further: about 25%. Consumption has declined, while production has increased. Seems to suggest that market pricing still has at least some effects on energy...

According to: http://www.data360.org/pub_dp_report.aspx?Data_Plot_Id=768

GDP, four qtrs through April 2011, is still below 2007 in real $.

Imports are about 6% above 2007 in unadjusted dollars. Maybe down 2% in real dollars according to BLS:ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt

Where do your numbers come from?

My GDP numbers were from the US BEA: http://www.bea.gov/national/xls/gdplev.xls

Now, the numbers in the 2nd quarter, and at that point are only .4% below the 2007 peak-the 3rd quarter has ended, so we've likely regained that .4%. If not, would it make a difference to the basic point?

Oil imports are sharply down when measured in barrels, which is the usual method, especially on TOD.

Net imports peaked at 12.48M bpd in 2005, and now are down to 9.07M bpd, for a total reduction of 27%. Meanwhile, GDP rose by about 5%.

He says that GDP has grown much more quickly than energy consumption

Of course another way of saying that is that each unit of energy now provides more units of GDP than it used to--which means that if you remove units of energy a greater number of GDP units are now removed with them. Of course using energy more efficiently could ameliorate that depending on the rate of efficiency increase. But spending more energy just to produce energy does remove energy from the economy that would have been available for other work. Of course the dog chasing its tail effect of spending more energy to get energy still shows up as GDP growth (if the energy is produced domestically) but it likely loses much of its multiplier power even in GDP calculations as it is effectively a tax on all households who's consumption makes up 2/3 of GDP.

The average US car gets 21MPG - new US cars get more than twice that without even going hybrid.

but does the average new US car get better than 42mpg?

if not it certainly is not

perfectly obvious that the US could reduce it's oil consumption sharply while still growing economically

at least in the near term.

if you remove units of energy a greater number of GDP units are now removed with them

As you note, that's only if energy efficiency can no longer be increased, which is unrealistic in the current situation.

spending more energy just to produce energy does remove energy from the economy that would have been available for other work.

Which would be a problem if we didn't have an enormous surplus of energy currently.

does the average new US car get better than 42mpg?

They could - that's just a social choice.

at least in the near term.

And in the long-term: if everyone drove EREVs like the Volt the US would eliminate 50% of oil consumption. Move trucking to rail takes care of another 10%. The remaining 40% varies in it's resistance to substitution, but in the end we don't need oil for anything we do now, and we have quite a long time to get there.

As you note, that's only if energy efficiency can no longer be increased, which is unrealistic in the current situation.

its the rate of energy removal/rate of efficiency gain that matters. It could be a very bumpy road with bottlenecks (seems to be my word of the week)

Increasing the percentage of energy needed to produce energy can be a big drag on the economy--of course if the new more expensive energy is being produced domestically and is replacing cheaper energy that was bought abroad the net effects short and long term are much more complex. Debates have run long and heated here on just how much wind and solar really cost. The big two questions 1. how much extra energy it will take to produce just what we use now (counting transport) with them? 2. and how will it be financed? That is why I have to agree with ROCKMAN that to keep things rolling coal coal and more coal will probably be at least the US answer. Don't know that we 'are smarter than a fifth grader' by locking in on that one.

And in the long-term: if everyone drove EREVs like the Volt the US would eliminate 50% of oil consumption

well if westexas is right on his ANE projections we'd best 'gets to hoppin' on that one.

its the rate of energy removal/rate of efficiency gain that matters. It could be a very bumpy road with bottlenecks

No question. OTOH, we could reduce our oil consumption in weeks by 10% with carpooling, with not much inconvenience. We could get 25% with carpooling, though with a lot of inconvenience. But, everyone would still get to work. And, we could reduce oil consumption by 25% in 15 years just by doubling MPG, with no inconvenience at all.

Increasing the percentage of energy needed to produce energy can be a big drag on the economy

Windpower has a high E-ROI, probably 50:1 - that's higher than oil, now. So, going to wind won't really increase the % of energy needed.

how much extra energy it will take to produce just what we use now (counting transport) with them?

It will take much less: a gallon of gas has about 35kWhs, and will take the average US car 21 miles. 35kWhs in an EV will take you about 100 miles.

how will it be financed?

Utilities can pay for it out of revenue.

coal will probably be at least the US answer

Could be. It doesn't have to be, but the coal industry may continue to succeed in buying Congress and the media.

we'd best 'gets to hoppin' on that one.

Yes. Of course, the US has reduced Net Imports by 25% in the last 4 years, so we're on the way.

Nick, unfortunately, some of that 25% reduction was due to the higher unemployment rate and reduced industrial production. Hopefully we can reduce the oil demand further without those negatives occurring.

some of that 25% reduction was due to the higher unemployment rate and reduced industrial production.

Well, the economy has grown to a point higher than where it was 4 years ago (in terms of both general and industrial production), while oil consumption is 10% lower. Combine reduced consumption with increased production and we get a sharp reduction in net imports.

For better or worse, labor productivity keeps growing whether we need it to or not, raising unemployment in periods when production isn't growing fast enough.

Hopefully we can reduce the oil demand further without those negatives occurring.

I agree. It's very, very possible. Heck - just choosing higher MPG vehicles (much higher, ideally) will get us most of the way.

Care to explain that to me in more detail?

A gallon of gas has the energy equivalent of about 35kWhs, but the average US vehicle only uses about 15% of it in it's small, inefficient infernal combustion engine. On the other hand, the electric motor in an EV is roughly 90% efficient.

FWIW, the Chevy Volt is rated at 93 miles per gallon-equivalent (33.7kWh), so 100 miles is a pretty reasonable ballpark estimate.

Yes, thanks.

Also, the Nissan Leaf gets 99 equivalent MPG.

The Volt is handicapped a bit by being a 1st generation Extended Range EV - the 2nd generation will get better, with improved charging efficiency, aerodynamics, batteries and a custom ICE generator/engine.

It will take much less: a gallon of gas has about 35kWhs, and will take the average US car 21 miles. 35kWhs in an EV will take you about 100 miles.

This is where you seem to miss the point. How many kWhs are expended in delivering the gallon of gasoline to the car? That is the important number, not how many kWhs the gallon contains. Then you calculate how far the kWhs expended to deliver the fuel to the car will carry the car. That will give you an apples to apples comparison with an EV mileage. An ICE rig could waste ninety-nine percent of the solar energy stored in the gallon of gasoline and still get better 'mileage' than an EV using its electric supply with ninety-nine percent efficiency if kWhs expended delivering the gasoline to the car was a small enough number. We didn't expend any of our effort storing the energy in fossil fuel, we only expended it in delivering (the whole process from exploration through to the gas pump) the gasoline to the car.

I guess I'm not really clear on your point. Oil in the US probably has an E-ROI of about 5, so a gallon of fuel at the pump probably means 1.2 gallons of fuel total. On the other hand, delivering the electricity to the point of EV charging probably has similar overhead: 7% transmission losses, etc.

Again, windpower has a higher E-ROI than oil at this point (50:1 versus about 10:1). In other words, we don't expend much energy procuring the power for an EV.

I do not believe the wind power has an ERoEI of 50:1 at the household outlet, it is more complicated than that, but that is not important here.

It still takes 1 kWh of produced energy delivered to the EV to take it set distance. It also takes 1 kWh of energy to produce a certain amount of liquid fuel delivered at the retail pump that will take the ICE a set distance. Those are the kWhs and distance numbers we must compare, not the total potential kWh of the what could be gleaned from burning the fossil fuel. The kWh used to deliver the gasoline to the pump could theoretically come from the same wind source that the kWh used to charge the EV comes from. Of course in practice that is not going to happen, but this key post is about GDP economics, little inconveniences like that are totally ignored in those type calculations.

You and I are really talking about embedded produced energy. If the homeowner's wind gen or solar panels are powering the car, we will only have to consider the kWhs required to make, install and operate the products that deliver the power to the EV, not the actual power required by the EV since we put no effort into producing the sunlight or wind but only into the harnessing of it. This gets extremely complicated and is why embedded energy numbers are generally so suspect (determining the energy embedded in a dollar of capital is a can of worms that elicits near endless debate-but the total kWh embedded in any item must include that as well). But regardless of all the twists and turns, the actual kWhs a kilo of fossil fuel could theoretically produce are not important in the calculations. We just need to know how many kWhs that kilo sucked up in getting to the end use point and how much work (and will call moving a car work for these purposes) was done with them.

If I understand you correctly, you're really talking about the E-ROI of oil vs alternatives.

If oil has an E-ROI of 5:1, then it takes an input of roughly .2 units of energy to deliver 1 unit of energy. Similarly, if wind has an E-ROI of 50:1, then it takes .02 units to deliver 1 unit.